Since its inception in October 2023, Park Financial Consulting claims to offer FX and CFD trading services worldwide. However, a closer look at this company’s operations reveals a disturbing picture of potential fraud and deception. In this in-depth review, we will expose the various aspects of Park Financial Consulting, examining its alleged regulatory status, trading features, withdrawal processes, and more.

The Financial Conduct Authority (FCA) has also published a warning about this company.

Regulatory Status and Safety of Park Financial Consulting:

One of the most critical aspects of any trading platform is its regulatory status, ensuring the safety of investors. Park Financial Consulting, however, claims to be unregulated, casting doubts on the safety of funds deposited with them. Despite asserting multiple regulations from entities like IFSC (Belize), FCA, ASIC, CySEC, DFSA, and FSCA, detailed research has shown no concrete evidence of such oversight. The UK’s Financial Conduct Authority (FCA) has even issued a warning against Park Financial Consulting, exposing the company’s false claims of transparency and security.

Targeting Victims and Geographic Focus:

Park Financial Consulting is alleged to have targeted specific countries, including the United States, Poland, and Germany. Despite these countries having strong regulatory oversight, the company has reportedly attempted to scam their citizens. Victims are encouraged to share their experiences, and a team of specialists is available for consultation regarding potential refunds.

Investment Costs and Lack of Transparency:

The company’s purported transparency is called into question as it fails to disclose essential information such as trading costs, overnight swaps, stock trading commissions, and fees. This lack of transparency raises concerns about the legitimacy of Park Financial Consulting.

Bonus Policy and Trading Features at Park Financial Consulting:

The bonus policy of Park Financial Consulting raises red flags, with traders reportedly unable to withdraw funds generated with a credit bonus. The legitimacy of the offered trading features, including contract trading, PAMM Accounts, access to IPOs, and copy trading, is also questioned due to the absence of regulatory credibility.

Regulatory License Requirements:

To highlight the non-regulatory nature of Park Financial Consulting, we explore the standard requirements for obtaining a regulatory license. Financial jurisdictions such as the UK or the European Economic Area (EEA) demand a minimum operating capital, negative balance protection, segregated accounts, safe leverage caps, and compensation scheme contracts—all of which the company appears to lack.

Trading Platform and Assets:

Non-licensed companies often pose risks related to their trading software. Park Financial Consulting fails to disclose its technology, suggesting potential manipulation. The availability of tradeable assets, including Forex pairs, commodities, stocks, cryptos, and indices, is also questioned due to the lack of evidence supporting these claims.

Account Types, Mobile App, and Demo Account at Park Financial Consulting:

The company offers various account types, each tailored to specific asset categories. However, the absence of regulatory credibility raises doubts about the benefits associated with these accounts. The lack of a mobile trading app and a demo account further diminishes the trustworthiness of Park Financial Consulting.

Education and Customer Support:

The review uncovers limited educational resources provided by the brokerage, with only webinars mentioned. The credibility of these educational offerings is undermined by the company’s fake regulatory statements. Despite claiming to offer 24/7 customer support, the lack of professionalism due to multiple lies casts doubt on the reliability of Park Financial Consulting’s customer service.

The company in question, Park Financial Consulting LTD, has been subject to a thorough investigation to ascertain its legitimacy and adherence to regulatory standards. Despite a lack of specific information regarding its registration location, diligent efforts have been made to uncover relevant details.

One key aspect of the investigation involved exploring the contact information provided, namely a contact number in the UK and a mention of the UK regulator. Based on this information, it was inferred that the company might be registered in the UK. Subsequent verification confirmed the existence of an organization with the same name in the registry. However, notable disparities were found, such as differences in the registered address and the establishment year, which was recorded as 2010 instead of the claimed 2020 by the organizers of Park Financial Consulting LTD.

This discrepancy raises concerns about the company’s transparency and credibility, suggesting a potential attempt to leverage the established reputation of the legitimately registered entity for deceptive purposes.

To further scrutinize the legitimacy of Park Financial Consulting LTD, an examination of licenses from regulators referenced by the project’s leaders was conducted. Disappointingly, no evidence of the company’s presence or the possession of necessary licenses was found in the registries of the mentioned regulators. This corroborates the suspicion that Park Financial Consulting LTD is operating unlawfully, falsely associating itself with brokerage services.

The company’s claimed commencement of operations in 2020 was cross-verified using the Whois service, revealing inconsistencies that cast doubt on the accuracy of the information provided by the project’s creators. This further underscores the potential falsehoods surrounding the company’s history and operations.

Despite Park Financial Consulting LTD’s encouragement for individuals to reach out via a provided telephone number and email, caution is warranted, as the investigation has uncovered that the given address is identified as fake. This discovery adds to the mounting evidence suggesting a lack of transparency and credibility on the part of Park Financial Consulting LTD, signaling potential risks for those considering engagement with the company.

Victim Testimonials and Recommendations:

The review includes testimonials from individuals who claim to have fallen victim to Park Financial Consulting’s scams. These testimonials shed light on the methods used by the company, such as luring individuals on social media with promises of high profit margins.

Warnings and Legal Implications:

Financial watchdogs in the United States, Germany, and Poland have strict regulations to prevent unauthorized entities from conducting fraudulent schemes. CONSOB’s warning underscores Park Financial Consulting’s lack of a license to operate in Europe, eliminating the possibility of financial ombudsman or compensation scheme contracts for affected individuals.

Withdrawal Process and Customer Support:

The company’s withdrawal process, despite claiming to take 48 hours, is criticized for potential delays and obstacles. The Partnership Compensation Plans are highlighted as potential hindrances to withdrawals, adding to the concerns. The lack of disclosure regarding withdrawal fees raises suspicions about the company’s commitment to transparency.

Park Financial Consulting has set its maximum leverage at 1:500, a significantly higher limit than what is permitted in Europe (1:30) or North America (1:50). While high leverage can amplify potential profits, it also escalates the risks of substantial losses, making it a double-edged sword.

The lack of transparency regarding trading costs, including spreads and commissions, is a red flag. For beginners, this non-disclosure raises concerns, emphasizing the importance of avoiding such non-transparent conditions.

A prudent suggestion is to start with a demo account before committing real money to trade. Reputable brokers commonly offer free trial periods for users to practice with virtual funds. Caution is advised against fraudulent platforms like CoinsTrades.

In our comprehensive analysis, Park Financial Consulting is deemed a fraudulent Forex trading scam, primarily targeting traders in the US, Germany, and Poland. Notably, it has been blacklisted by the Financial Conduct Authority (FCA) and the Italian Securities and Exchange Commission (CONSOB).

Investing in Park Financial Consulting LTD may not offer the best returns, considering the broker’s primary offering of trading with substantial leverage. This approach significantly heightens traders’ risks, often resulting in rapid capital loss. Furthermore, CFD trading is prohibited under US legislation.

Withdrawals with Park Financial Consulting LTD are uncertain. Client reviews highlight a negative experience, casting doubt on the broker’s ability to fulfill withdrawal requests despite enticing offers.

The risk of being scammed on parkfinancialconsulting.com is alarmingly high. Despite the appearance of official registration and numerous brokerage permits, the lack of confirmation for these details is concerning. The broker promises insurance to traders but provides no guarantees for the safety of their funds. Notably, the site lacks official registration, physical offices, and licenses.

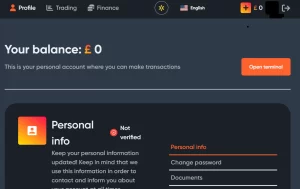

The registration process is notably standard, involving a simple questionnaire, and lacks a verification process. The absence of verification steps, such as receiving codes via email or phone, compromises user account security, leaving it vulnerable to unauthorized access, hacking, and fraudulent activities.

The client portal appears amateurish, lacking extraordinary features. Notably, access to the trading terminal and account configuration are the only notable functions.

Park Financial Consulting LTD necessitates users to undergo a verification process involving the submission of documents like passports or driver’s licenses and proof of address. However, the lack of specificity raises concerns about the effectiveness of this process.

The investment proposal from Park Financial Consulting LTD promises returns ranging from 21% to 37%, but the source of such profitability remains undisclosed. Interestingly, the client portal lacks features related to investing, contributing to suspicion and leaving crucial questions unanswered.

Conclusion:

In conclusion, Park Financial Consulting presents itself as a multi-regulated brokerage, yet our in-depth analysis reveals a lack of any issued licenses and multiple warnings from reputable authorities. The company’s deceptive practices, combined with a lack of transparency, cast significant doubt on its legitimacy. Investors are urged to exercise extreme caution, and those who may have fallen victim to this potential scam are advised to explore options such as chargebacks and alternative payment solutions for fund recovery. The need for regulatory oversight in the financial industry is underscored by Park Financial Consulting’s case, emphasizing the importance of due diligence before engaging with any trading platform.

For more genuine reviews on this kind of company, visit the website at www.marketrefree.com